What is “Japan’s Lump-Sum withdrawal payment?”

Did you know that you can receive some amount of National Pension Insurance when returning to your country?

As of 2021, 1.7million Foreign Nationals are working in Japan. Most of them are paying the National Pension Insurance.

First of all, National Pension Insurance is the system for supporting your elderly life living in Japan. Paying the National Pension Insurance is your obligation to all residents, no matter which nationality you are. Some Foreign Nationals who are not planning to work in Japan for their entire life may feel it unnecessary to pay the insurance.

Hence, the system called “Lump-Sum withdrawal payment” is available.

This article will explain how and how much you can receive from the Lump-Sum withdrawal payment system.

Lump-Sum Withdrawal Payment

The “Lump-Sum withdrawal payment” system refunds insurance to people whose insured periods are six months to less than ten years. The refund amount depends on the amount of insurance paid or the insured period.

* There are roughly two kinds of insurance in Japans’ public pension system: National Pension Insurance and Employees’ Pension Insurance. National Pension Insurance applies to all residents, and Employees’ Pension Insurance is for those who work for a company.

The following article explains the Employees’ Pension Insurance which most of the Foreign Nationals working in Japan are enrolling.

Requirements to receive the “Lump-Sum withdrawal payment.”

Requirements to receive the “Lump-Sum withdrawal payment” are as follows.

- You do not have Japanese nationality.

- The number of months of the Employees’ Pension Insurance enrollment period is six months or more.

- The Sum of the contribution paid period of Employees’ Pension Insurance is less than ten years.

- You were never eligible to receive a pension (including disability allowance).

- You do not have an address in Japan.

- You are within two years from the last time you lost your qualification as an insured person of the Pension. (the day you no longer have an address in Japan)

How to apply for the “Lump-Sum withdrawal payment.”

The application procedure is even possible before you leave Japan.

Submit Moving-out Notification to the municipality of your residence, and submit your claim with the following documents to the Japan Pension Service after submitting the Moving-out Notification and the (planned) deletion date of your residence record.

If you fill out the documents without any error, Withdrawal Payment is transferred around four months after the application acceptance.

Claim Form by several languages is available here.

*“Copy of resident’s card exemption” can be issued by submitting a Moving-out Notification to the municipality.

Amount of “Lump-Sum withdrawal payment.”

According to the following calculation, the law determines the “Lump-Sum withdrawal payment” amount.

*By April 2021, the maximum insured period is set to 60 months (5years) for those who last paid the insurance after April 2021.

Calculation formula

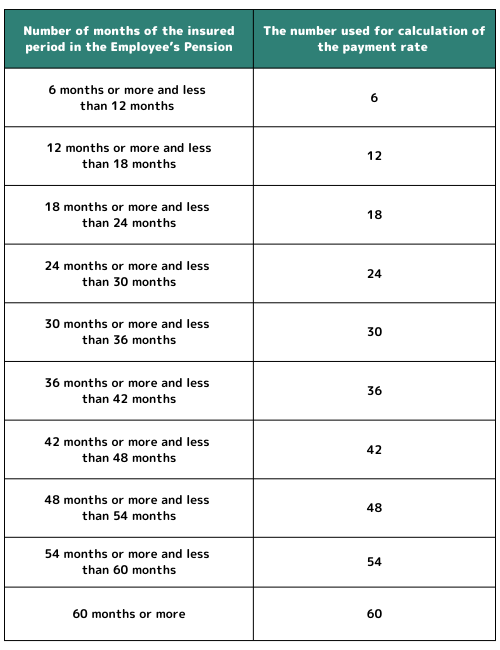

Average monthly wage for the insured period × Payment Rate (Insurance Rate of 18.3% × 1/2 ×The number used for calculation of the payment rate*)

*The number used for calculation of the payment rate

Example 1

Monthly wage 150,000yen + 2 months bonus/year, Insured period of 3 years

Average monthly wage

Monthly standard wage

150,000yen x 36 months = 5,400,000yen

Bonus

150,000yen x 2months x 3years = 900,000yen

Average monthly wage

(5,400,000yen + 900,000yen) ÷ 36 months = 175,000 yen

Lump-sum Withdrawal Payment

175,000yen × 18.3% × 1/2 × 36 = 576,450 yen

However, 458,739yen is the actual transfer amount as income tax of 20.42% is withheld at the source at the time of payment.

*Income tax of (117,711yen) is refunded after your submission.

Example 2

Monthly wage 200,000yen + 2 months bonus/year, Insured period of 5 years

Average monthly wage

Monthly standard wage

200,000yen × 60 months = 12,000,000yen

Bonus

200,000yen× 2 months × 5years = 2,000,000yen

Average monthly wage

(12,000,000yen + 2,000,000yen) ÷ 60 months = 233,333 yen

Lump-sum Withdrawal Payment

233,333yen × 18.3% × 1/2 × 60 = 1,280,998yen

*However, 1,019,418yen is the actual transfer amount as income tax of 20.42% is withheld at the source at the time of payment.

*Income tax of (261,580yen) is refunded after your submission.

Income Tax Refund procedure

You may receive a tax withholding refund by requesting for submission of Income Tax Refund through the “Tax Agent.”

*Tax Agent

The “Tax Agent” is a person submitting the procedure of taxes on behalf of the Taxpayer.

(There is no particular qualification for the Tax Agent other than having an address or residence in Japan.)

- 1.Payment of “Lump-Sum withdrawal payment” completes.

- ・Japan Pension Service is sending you the “Notice of Lump-sum Withdrawal Payment Determination.”

The amount printed in the Notice is the amount of money to be transferred to your account. - ・Keep the Notice for submission.

- 2.Prepare “Notification of Tax Agent for Income Tax/Consumption Tax” and “Final Tax Return.”

- ・When your Tax Agent is assigned, prepare “Notification of Tax Agent for Income Tax/Consumption Tax.”

・Prepare “Final Tax Return” and fill out the Tax Agent and its Bank Account.

- 3.Send documents to the Tax Office

- ・The Tax Return should be submitted to the tax office with jurisdiction over your final address or place of residence in Japan

・Submit the original document of “Notice of Lump-sum Withdrawal Payment Determination.”

- 4.Refund is transferred to the account of your Tax Agent.

- ・Tax office sends the “National Tax Refund Transfer Notice” to the Tax Agent’s address.

・Refund is transferred to the Tax Agent’s account you have declared on the submission.

- 5.The Tax Agent will transfer the refund to the applicant.

- ・Your Tax Agent will transfer the refund to your bank account.

- 6.Dismissal of the Tax Agent

- ・When all the refund procedure is done, your Tax Agent is dismissed by submitting the “Notification of dismissal of a tax agent for income tax/consumption tax” to the Tax Office.

- Reference: Japan Pension Service “Lump-sum Withdrawal Payments”

Summary

If you decide to leave Japan within an insured period of fewer than ten years, you are eligible to claim “Lump-sum Withdrawal Payment.”

Receiving back the amount perhaps helps you after returning to your country.

If you are thinking of working in Japan, make sure you fully understand the subjects of the pension system so that you can exercise your rights.